Time for action

TO PREPARE FOR DEEP DECARBONISATION AND THE IMPENDING TRANSFORMATION OF THE OIL AND GAS INDUSTRY, ARVE JOHAN KALLEKLEV IS ENCOURAGING STAKEHOLDERS TO ADOPT A SHIFT IN MINDSET AND BEGIN TAKING ACTION

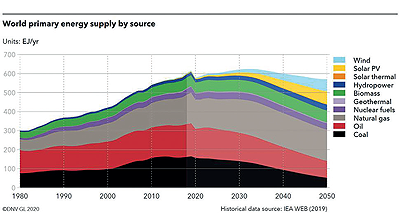

DNV GL’s 2020 Energy Transition Outlook (Figure 1) predicts that without greater effort to meet low or zero-carbon emissions by mid-century, the world will miss the 2°C limit for global warming

under the Paris Agreement.

In line with current emissions trends, the 1.5°C carbon budget will be exhausted in 2028 and the 2°C budget in 2051. This points to a 2.3°C warming of the planet by 2100, compared with the pre-industrial level.

Shifting oil demand

The report predicts global primary oil demand will fall 13 per cent in 2020, reaching a level not seen since the early 2000s. Oil will retake its place as the world’s largest energy source in 2021, before giving way to natural gas in the mid-2020s (Figure 2). Demand will see a brief recovery towards 2023, before gradually decreasing to half of its 2018 level (in real terms) by 2050. Oil and gas will still hold a key role in the energy mix in 2050 as it is forecast to supply half of the world’s energy.

With increasing societal, governmental, investor and industry-led pressure to address carbon emissions and climate change issues, the energy transition will become a focal point for the sector – though actions associated with realising these climate ambitions will be slower to materialise.

CO2 emissions not accepted

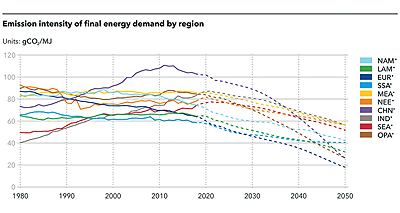

The oil and gas industry will need to prepare itself for an energy system that does not accept the release of carbon emissions. However, our predictions show that CO2 emissions will remain stubbornly high until the mid-2030s, falling just 15 per cent in the next 15 years, before then dropping 40 per cent in the 15 years to 2050.

Emissions intensity (energy-related CO2 emissions/energy demand) will remain elevated in regions and countries which supply the world’s oil and gas, predominantly in areas with low production costs or easily scalable operations. Financial benefits, particularly in the short term, as well as a domestic economic reliance on fossil fuels, will result in continued oil use in these areas (Figure 3).

The report asserts that in the UK, a total of 13.1 MM metric tons of carbon dioxide (CO2) will be from oil and gas production. Extraction emissions account for 10.1 MM of CO2, the rest is due to flaring. In comparison, in 2019, Norway’s oil and gas production emissions were 4 MM of CO2 and Denmark’s 1.4 MM1.

To achieve this decline, there should be a focus on scaling the decarbonisation of natural gas, which even though it is predicted to be the world’s largest energy source at mid-century, has seen little progress in technologies for cutting carbon. Key solutions include electrification, reducing flaring and venting, increased efforts to detect and stem methane leaks, and efficiency gains through digitalisation of the value chain.

The electrification of oil and gas assets, including exploration and production rigs, platforms and vessels, is underway. There are already eight partly- or fully-electrified oil and gas fields operating offshore Norway, with a further eight fields covered under sanctioned electrification projects.

In the UK, feasibility studies for platform electrification schemes in the central North Sea and west of Shetland are in progress for several companies, with low-emission designs being embedded

into future field development plans.

The Oil and Gas Technology Centre (OGTC) estimates that £430 billion ($557 billion) of new investment will be needed ‘to close the gap on a number of crucial technologies and accelerate their deployment’. Converting the North Sea into an integrated net-zero emissions energy system is forecast to create more than 200,000 jobs and £2.5 trillion ($3.2 trillion) in value to the UK economy2.

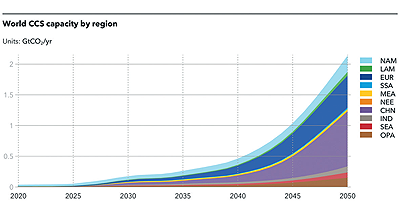

CCS as a long-term catalyst

Now in its fourth year, the Outlook envisages that the oil and gas sector could become the leading ‘decarbonizer’ of hydrocarbons. Catalyst technologies such as carbon capture and storage (CCS) and hydrogen as a vector fuel are expected to transform the industry after 2035. Complementing renewable electricity, battery technology and alternative low-carbon fuels, the industry could also become the world’s largest supplier of CCS. However, its uptake will be inhibited by high costs, with the technology not beginning to scale until the 2030s, and not to a significant level until the 2040s.

In comparison to last year’s forecast, though policy and technology developments for CCS capacity have almost trebled in the last 12 months it still falls short of climate change targets by mid-century. By then, China and Europe combined are expected to account for 66 per cent of the world’s CCS deployment (Figure 4).

An agreement on a carbon price will allow CCS to scale more quickly. If a major country or region is to set a carbon price high enough to make large-scale CCS a reality, this will subsequently lower the cost of the technology in other regions as others follow. Hydrogen will face a similar challenge.

There are around ten large projects planned in Europe, mostly around the North Sea, which have a high chance of being operational by 2035. In September, the Norwegian Government proposed to launch a CCS project called ‘Langskip’ (‘Longship’)3. Total’s investment in this project is an estimated NOK17.1bn. Promising projects are also developing in the UK, Denmark and Netherlands, with Ireland and Italy also making progress.

The technologies required to accelerate the energy transition are available to us today. But we need to take action and scale these at a much quicker pace to build a decarbonised future for the industry and make a positive impact on the energy transition and climate goals.

References

1. https://www.rystadenergy.com/newsevents/news/press-releases/top-north-sea-emitter-uk-needs-to-electrify-its-rising-oil-and-gas-output-to-reach-climate-goals/

2. https://www.theogtc.com/newsroom/news/2020/closing-the-gap-realising-a-net-zero-north-sea/

3. https://www.regjeringen.no/en/aktuelt/the-government-launches-longship-for-carbon-capture-and-storage-in-norway/id2765288/

DNV GL

Arve Johan Kalleklev is Regional Manager Norway & Eurasia with DNV GL – Oil & Gas. DNV GL is the technical advisor to the oil and gas industry. It brings a broader view to complex business and technology risks in global and local markets. Providing a neutral ground for industry cooperation, it creates and shares knowledge with its customers, setting standards for technology development and implementation. From project initiation to decommissioning, its independent experts enable companies to make the right choices for a safer, smarter and greener future.