CBM: cost vs reliability

Lee McFarlane looks at why more operators are being prompted to implement a technology-based approach with an integrated Condition Based Monitoring programme

The choices made when it comes to maintenance and inspection strategies for both rotating equipment and structural integrity monitoring can have major consequences on equipment reliability and costs. But structural integrity and rotating equipment monitoring are often viewed by offshore operators as separate and distinct areas; with different management structures, systems and personnel driven by different KPI’s and regulatory requirements. However, with advances in condition monitoring technology, one of the key opportunities is integration of both compliance and maintenance driven monitoring.

It is now widely accepted by oil and gas companies that Condition Monitoring (CM) is an excellent maintenance strategy that provides asset operators a proactive means to reduce non value added PM activity and gain insight into both rotating and static equipment condition. This technique allows a two-pronged approach by firstly allowing streamlining historic maintenance resource requirements to fulfil these PM strategies on both safety critical and production critical systems. Secondly, it enables allocation of these limited resources to the areas where value can be added and ultimately have a direct impact on system availability and lower operational expenditure.

For many decades, the oil and gas industry has adopted CM in many forms and have been at the forefront of leading proactive maintenance strategies. However, more recently, during these tougher times, specifically with low oil prices, operators are questioning the value and typically high cost of traditional methods for CM.

Cost vs reliability relationship

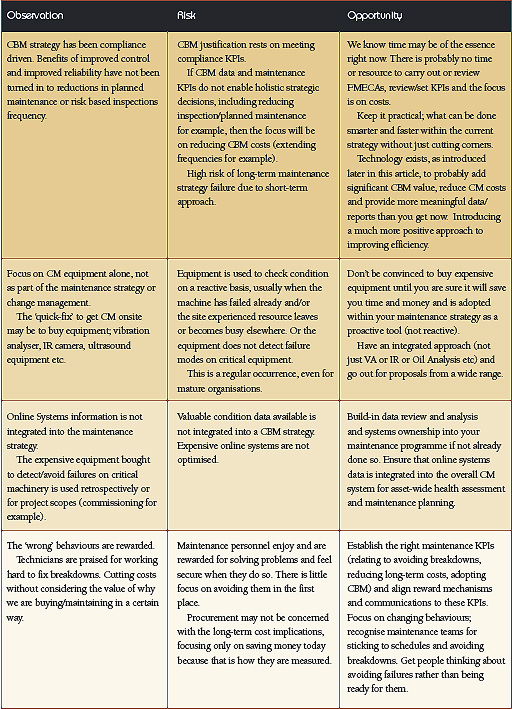

We will assume for the purpose of this article, that readers will be well aware of Condition Based Maintenance & Risk Based Inspection strategies and CM techniques. The graph overleaf demonstrates a typical cost & reliability relationship over time, for an operator with sub-optimal CBM strategy moving to an optimised approach.

It is the development of new technologies that are enabling operators in the oil and gas sector to run successful CBM programmes. Being able to visualise this data, often via a live feed, means that decisions can be made in achieving the optimum performance from a specific piece of equipment. In most instances, we are able to create a typical five-year forecast for each machine showing maintenance costs over time. Operators can then use this information for strategic decision making, for instance, capital budgeting process.

This focus on technology has been a central part of our activity and since we developed Machine Sentry® in 2006 there has been over five million readings logged on over 240 client sites in the UK alone. That success – it is the most widely used CM system in onshore industry – has come from a previously unsatisfied demand for easy to use CM tools, automatic report generation, integration of all CM techniques (VA, Oil Analysis, IR, watch-keeping data etc). However, the key factor that lowered the barriers for such a cost-conscious sector as the oil and gas sector was the significantly lower cost to implement a technology based CBM compared to traditional CM tools, Machine Sentry® being a good example of this.

The low price of oil also prompted firms to focus more closely on the cost of production and ‘think outside the box’ when it comes to how they use equipment capital budgets. For example, they may have used traditional CM techniques (such as set maintenance intervals, dismantling and inspection of equipment – which is time consuming and prone to error in itself). Unsurprisingly, operators have been quick to embrace technology-based, integrated CBM solutions, which includes vibration analysis, lubrication analysis, thermal imaging and ultrasound, plus others. This approach is quicker, more accurate and does not require asset downtime. As shown in the graph above, it also allows operators to accurately predict the maintenance costs and life expectancy of each asset. Accurate management decision can be made using this data, such as knowing when maintenance costs have reached a point where asset replacement becomes the best option, a useful insight when putting together capital budgets.

Conclusion

In the last 18 months and probably due to oil and gas operators having to focus on cost of production as a result of oil price shifts, and thinking outside the box, the use of this kind of technology is growing rapidly in this key sector. For instance, we have just completed the implementation of Machine Sentry® on four mature North Sea UKCS assets. The contract provides the operator with two of our consultant engineers deployed across the offshore assets, to carry out integrated CBM and reliability services. They are already seeing improvements from having a single holistic CBM and reliability-focused approach.

Paul Stamper, Maintenance & Reliability at Enquest, managed the process from RFQ to operation and said: “I am really impressed with the speed at which the AVT team have integrated with both our offshore and onshore teams, they have identified some high level areas of asset availability risk on both safety and production systems. This has allowed us to direct our resources to enable maximum focus, which ultimately affects our bottom line. Their Machine Sentry system is what gives AVT the edge.”

Machine Sentry® was used on Bluewater for two of their FPSOs 18 months ago. The operators were looking for a more cost-effective and powerful system, especially one where they didn’t have to buy a data collector (Machine Sentry® works with almost any PDA and plugs in to Bentley Nevada panels and easily incorporates the data). Since then, there has been interest from Shell, who are now implementing it on their Corrib asset in Ireland, where it will demonstrate better ways of working, especially the fact that using the tri-axial capabilities makes data collection five times faster than the current system.

Condition Monitoring (CM) is an excellent maintenance strategy to enable asset operators a proactive means to reduce non value added PM activity and gain insight into both rotating and static equipment condition.

AVT Reliabilities

Lee McFarlane is AVT Reliabilities General Manager Energy and Infrastructure. AVT Reliability has been at the forefront of rotating equipment condition monitoring and structural integrity monitoring in the offshore sector since 1976. Over the years the company has established itself as a leading provider of asset management and reliability solutions to industry.

For further information please visit: avtreliability.com