Concedo ASA: Leading Exploration Success on the Norwegian Continental Shelf

Discovering opportunities

With a proven track record in the exploration, discovery and selling of fields on the Norwegian Continental Shelf (NCS), Concedo ASA has made impressive progress in its ambition to operate as one of the region’s best and most effective exploration companies.

The business was originally established as a consultancy company during 2005, before Concedo later transformed itself into an oil company during late 2006. Concedo was then pre-qualified as a partner company on the Norwegian Continental Shelf during 2007 and developed its strategy of concentrating on the exploration of the Norwegian shelf as a non operating company. Over the proceeding years the company enjoyed encouraging levels of success, establishing Concedo as an expert in oil and gas exploration as well as creating a solid base from which to grow the business. “The main business plan for Concedo is to operate as an effective explorer and to sell the resulting discoveries prior to field development,” explains Managing Director, Geir Lunde. “Many of the company’s most important discoveries came in 2009 and 2010, of which the Maria discovery in 2010 was the most significant. All of these discoveries were sold during 2010 and 2011 and the income from these sales made it possible for us to increase our exploration activities and also to pay back our shareholders all of the paid in capital. This means that all of the original investors in Concedo have enjoyed a good return.”

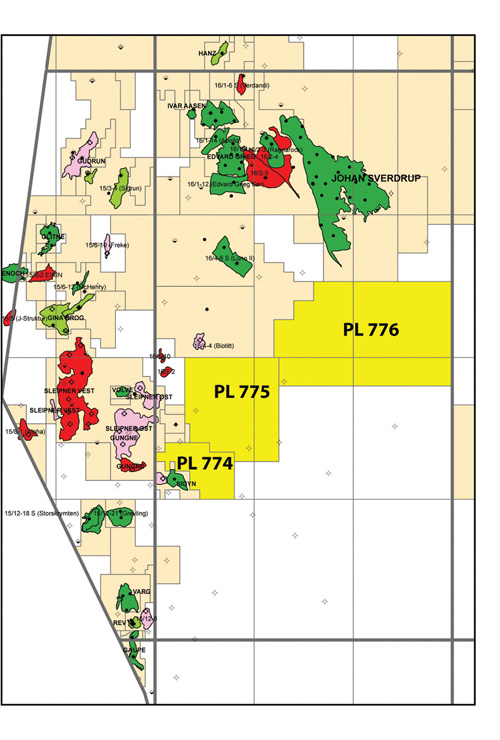

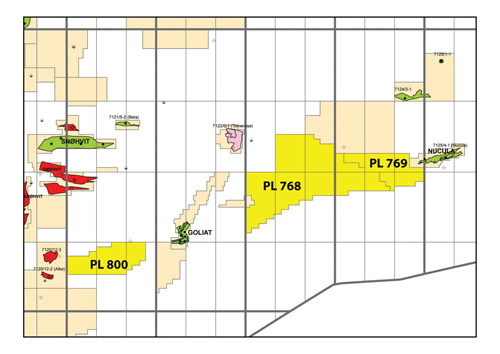

Since the company was last profiled during November 2012, Concedo has continued to follow its strategy of oil and gas exploration within the NCS and acquired an exciting portfolio of exploration licences close to the Gullfaks field operated by Statoil; the Johan Sverdrup/Edvard Grieg fields operated by Statoil and Lundin; and the Goliat field operated by Eni. It is the ambition of Concedo to contribute with additional resources close to these fields.

The Gullfaks field was discovered in 1978 and since its start-up in 1986, the field has produced around 2.56 billion barrels of oil and more than 70 billion cubic metres of gas, with a peak production of around 200,000 barrels per day. During 2015 the Gullfaks partnership also submitted a plan to recover petroleum resources from a shallow zone above the main reservoir. The connection between Gullfaks and Concedo is through PL 746S, which is today 40 per cent owned by the operator Rocksource Exploration Norway (now Pure E&P), with Tullow Oil Norge and Concedo each owning 30 per cent. The main focus of the partnership in PL 746S was initially to evaluate the producibility and upside of the 29/3-1 discovery. It was later discovered by Rocksource Exploration Norway in 2014, that the Skinnfaks South discovery within the Gullfaks area probably extended into the area controlled by PL 746S. The study of both pressure data and seismic attributes contributed to the evaluation, which was subsequently agreed by Tullow, Concedo and external consultancies. Presently the partnership plan is to appraise both the Skinnfaks South discovery and the Hernar discovery (29/3-1) with a planned well in PL 746S.

“Hopefully a discovery in this location will contribute to value creation for both the PL 746S partnership and the Gullfaks field,” Geir says. “This well’s results will most likely illustrate how the plurality of companies on the Norwegian Continental Shelf contributes to value creation that otherwise would not have been realised.” The second region that Concedo will be focused on over the coming years consists of the area close to the Edvard Grieg and Johan Sverdrup fields, which were discovered in 2007 and 2010 with production due to start during late 2015 and 2019 respectively. The initial reserves of the Johan Sverdrup field alone are between 1650 and 3000 million bbl of oil and will be produced at a plateau rate of between 550,000 and 650,000 bbl/day, representing a significant resource base for Norway over the coming 30 to 50 years.

The third region is close to the Goliat field, which represents the first oil-producing field in the Barents Sea. It was discovered in 2000 and will probably begin production during 2015 or early 2016. “With about 180 million barrels, Goliat is not really a giant discovery yet. Hopefully, the field will live up to its biblical name when additional resources are proven in the area,” Geir elaborates. “Production will peak as early as in 2017 and from then on there will be capacity for tie-ins. All of Concedo’s licences in the Barents Sea are located close to this field. We also hope to obtain more acreage in this area.”

Although the diminished price of oil has created challenging conditions throughout the oil and gas market, Concedo is in an enviable position in that the reduced cost of drilling and seismic activity allows the company to carry out its operations at a reduced cost. “The drop in oil price is actually positive for us because we see the cost of drilling and seismic operations coming down drastically, which means that we can have more activity for less spending. Furthermore as we have sold our discoveries we have not been impacted by the low oil price and the dream scenario for us is that the oil price will rise in a few years time when we have new discoveries for sale,” Geir concludes. “The next 12 months will be focused on the areas close to the Gullfaks, Johan Sverdrup/Edvard Grieg and Goliat fields and decisions relating to drilling new wells. Over the next three to four years we will increase our efforts on obtaining further concessions close to infrastructure in order to create own value, as well as adding potential resources to existing fields.”

Concedo ASA

Services: Business: Hydrocarbon Exploration