Renewable Natural Gas (RNG) energy production pioneer, Evensol, opens landmark production sites in North Carolina

When David Wentworth and Benjamin Benson first began Evensol, it was ahead of the game. RNG production was a thing of the future, and they had a long way to go. Today, Evensol has ten years of success under its belt, with two fully operational RNG sites, and more in the pipeline. Its story is one of innovation and determination, as President and Chief Executive Officer, David Wentworth, begins: “My Co-founder, Benny Benson, and I first established the company in 2013. Our strategy was to create an equity-based development and acquisition company. At a time when a lot of folks in our industry were much bigger players, what made our concept different was its simplicity. A lot of competitors had inefficient development and operations processes, and we saw a gap in the market for something more streamlined.

“Our platform has always been based on biogas/biomethane. When we started, RNG was more of an idea than an actual market. The projects we are pursuing today weren’t really viable in the market yet, so our focus was landfill gas to electric projects. We ended up acquiring a small portfolio through a series of complex negotiations, financed through an Alaskan private equity partner and Caterpillar Financial.

Development opportunities

“Then, as business matured, we found that renewable power prices in the US were declining rapidly. There was a pushback on ‘green premiums,’ which resulted in downward pressure across the board. As traditional LFG to electric projects became more challenging, the market for RNG began to stabilize, supporting new project development. We felt the time had finally come to approach lenders and investors about supporting our RNG project development efforts. and the RNG market was on the rise.

“We started to look for a viable marketplace and concluded that the gas rights we had acquired to a pair of landfills in North Carolina would work. Through a series of negotiations, we converted those opportunities from potential power projects to renewable biogas projects. These last three years have been dedicated to the development, financing, designing, constructing, and now operating those two facilities. That’s pretty much where we stand now — we’re always on the lookout for new strategic opportunities, both acquisitions and greenfield developments. We expect there will soon be additional development opportunities to invest in; we are looking to replicate our successes of the last couple of years.”

Strategic sites

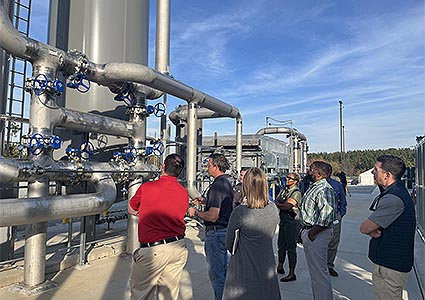

Foothills Renewables and Upper Piedmont Renewables, Evensol’s current operational projects, break new ground in more ways than one. As David details: “Both of the host landfills are owned and operated by Republic Services (Republic); the RNG plants are located next to the waste management facilities. As the second-largest municipal solid waste company in the US, Republic has historically offered some of its landfill sites to third party developers. We pay a royalty for the landfill gas, and in turn we can use it for our RNG project. Not only does the host landfill earn a royalty for our use of the gas, but also environmental benefits for participating in a sustainability project. The two RNG plant designs are basically identical, with both designed to process up to 3000 standard cubic feet of LFG per minute. Each facility cost around $50 million including hard costs, soft costs, development, design, and financing.

Foothills Renewables and Upper Piedmont Renewables, Evensol’s current operational projects, break new ground in more ways than one. As David details: “Both of the host landfills are owned and operated by Republic Services (Republic); the RNG plants are located next to the waste management facilities. As the second-largest municipal solid waste company in the US, Republic has historically offered some of its landfill sites to third party developers. We pay a royalty for the landfill gas, and in turn we can use it for our RNG project. Not only does the host landfill earn a royalty for our use of the gas, but also environmental benefits for participating in a sustainability project. The two RNG plant designs are basically identical, with both designed to process up to 3000 standard cubic feet of LFG per minute. Each facility cost around $50 million including hard costs, soft costs, development, design, and financing.

“We inject the RNG into different local distribution companies at each site, and each has a different power supplier. Otherwise, the projects are mirror images of one another. The goal is to produce RNG that is fully interchangeable with conventional natural gas. The process produces concentrated methane as the product (RNG) and eliminates all but trace amounts of carbon dioxide, water, nitrogen, oxygen, and a host of other compounds. The Foothills project is unique in that it’s a virtual pipeline project. This means that the year-round production volume from the plant exceeds what the local pipelines could handle. The solution is to transport RNG in high-capacity trailers to a decant station around 18 miles away for injection into the pipeline.”

Each Evensol project has a planned lifecycle. From beginning to end, David and his team work hard to get the most out of each location before its time is up. As he discusses: “The sites began producing last year, but since they’re supplied by a finite resource (landfill), we know that they won’t be producing forever. Designing the facilities with this in mind was essential. We size the plants according to their life expectancy, to get the most out of them, for as long as possible. If the landfill remains open and properly managed, the gas supply should steadily increase. Once the landfill closes, a lot of things will start to change. The gas production won’t cease immediately, but it will begin to drop off. Our job, as a developer, is to site projects on landfills that will produce a significant amount of quality gas, for a projected period and to a projected quantity. At full capacity, each of the Foothills and Upper Piedmont projects will produce roughly 500,000 dekatherms (Dth) per year; that’s a very significant amount of RNG production. We would expect both projects to continue to operate through the permitted life of each of the landfills, and beyond.

A future-focused business, Evensol is looking toward its next acquisitions and developments, even as it optimizes operations at its two operating plants. As David concludes: “We tend to look at the business in five-year arcs. Because of the nature of what we do, we must reframe our strategy based on the regulatory and political climate. The industry is highly regulated and relies heavily on state and federal compliance programs, so we must operate within those boundaries. The past two administrations have been generally favorable for us, and we expect the next five years will also support our efforts. With that in mind, we’ve been very active in trying to acquire new projects, and I look forward to seeing where this venture will take us next.”