The starting point

Stabilising R&D costs with portfolio and technology management amid oil price volatility. By Ben Thuriaux-Aleman

Only a few oil & gas firms have maintained their levels of R&D expenditure since 2012 due to decreasing revenues in the industry, at -51 per cent CAGR for selected benchmark companies. This originated from declining Brent spot prices year on year, from $109 in 2013 to $44 in 2016. Average annual decreases in R&D expenditure did not reflect the drop in regulation, which means the oil price reduction caused an increase in the proportion of R&D expenses.

Most majors have managed to realign these to control costs. As a result of the recent rise and then fall in oil prices, we anticipate only modest increases in R&D budgets to flow through in the next 12-18 months. However, we expect CTOs and CIOs to be more careful about their technology commitments in this next cycle.

Implications for CTOs and CIOs

To maintain themselves in these uncertain times, oil & gas firms require clear strategic directions from their CTOs to plan their investments, technology sourcing and piloting. We believe that with increased likelihood of fluctuations in R&D funding, focusing on technology deployment will be particularly important to ensure that the benefits of technology are realised.

In the context of cost control, agility in portfolio management and technology roadmapping are critical to ensure quick response to changes in oil prices and rebalance the portfolio of development activities. As part of their portfolio management, all companies will need to ensure that they have sufficient numbers of balanced new projects to push forward or scale back as necessary.

Technology management effectiveness

National oil companies (NOCs) are behind independents (IOCs) in terms of R&D effectiveness. In our experience NOCs improving efficiency in the management of technology is one of the most impactful ways to boost performance without increasing R&D budgets. The issues can be broken down into three main areas.

Strategic

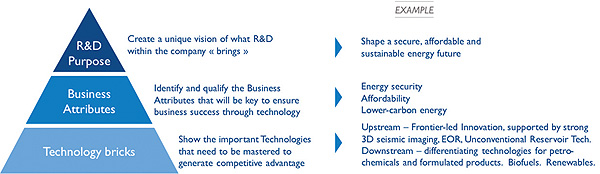

The technology portfolio management process is responsible for operationalising the strategy, but in NOCs the portfolio of technology activity is not managed as aggressively as in IOCs – some NOCs have never carried out full reviews of their R&D portfolios and lack the necessary data on the ranges of projects they fund to undertake such an exercise. This increases the likelihood that legacy projects will progress into large-scale investments, despite that the underlying economic rationale for their projects no longer makes sense. We have found that to achieve this, a mechanism is required for creating transparency between the highlevel strategy objectives, key areas the company wants to compete on (business attributes), core technical competencies of the organisation (technology bricks), and R&D programmes themselves.

Once the supporting relationship between the highlevel strategy and business attributes is established, and the relationship between an R&D programme and a technology brick or business attribute is clear, it is much easier to maintain alignment.

Once the supporting relationship between the highlevel strategy and business attributes is established, and the relationship between an R&D programme and a technology brick or business attribute is clear, it is much easier to maintain alignment.

Organisational

An organisation set-up that separates R&D from operations and isolates it from operational concerns typically results in few technologies being deployed to field operations. Operations tend to treat R&D as a tax, and do not actively manage the R&D budget. As a result, R&D focuses on long-term projects which struggle to compete with readily available external technology solutions, or which become irrelevant when operational strategy changes, the technology under development is superseded, or it is not made available on time to match key projects’ critical paths.

Conversely, if R&D is strongly linked to operations, we often see R&D staff drifting into providing increasing levels of technical service functions. This is typically driven by the scarce technical resources available, which means short-term fire-fighting of operational problems with required technical expertise takes priority over long-term development activities. This prevents R&D staff from delivering other projects on time.

A mechanism is required here for agreeing the balance of activity in the R&D portfolio by getting different parts of the business to clarify what they need and how these needs can best be served.

Process

Engagement with operating units on technology deployment is often problematic, with operating units sourcing their own solutions because technology roadmaps for acquired or developed technology are not fully shared and maintained in co-ordination with the assets. This is due to lack of communication among business units and assets. As a result, assets often lack budget provisions to pilot and deploy technology, and no one has had the difficult conversation about how deployment will be financed.

Clarity is needed on technology deployment plans and how technology will help the assets hit their longer-term performance targets.

Conclusion

From our case experience and study of R&D management best practices, we have found that the starting point lies with a prioritised technology strategy. Having such a strategy strongly linked to its corporate development strategy and core strategic business projects, as well as mastering a process to maintain this link, allows a company to make better use of available resources.

Looking forward, companies will need to define how they will cope with a potentially prolonged period of lower oil prices while maintaining active R&D programmes that are crucial to anticipating key trends such as digital capabilities. R&D strategic planning, as well as transparency between R&D activities and strategic goals, will be key to this challenge.

Arthur D. Little

Ben Thuriaux-Aleman is a Principal at Arthur D. Little. Founded in 1886, Arthur D. Little is the world’s first management consultancy. It is a recognised expert in companies that want to combine strategy, innovation and transformation in technologyintensive and converging industries. Arthur D. Little navigates clients through changing markets and ecosystems, helping them to take the lead and shape in this transformation.

For further information please visit: www.adlittle.co.uk