West Burton Energy’s CEO discusses acquisitions, expansion and the future and current climate of the UK’s energy industry

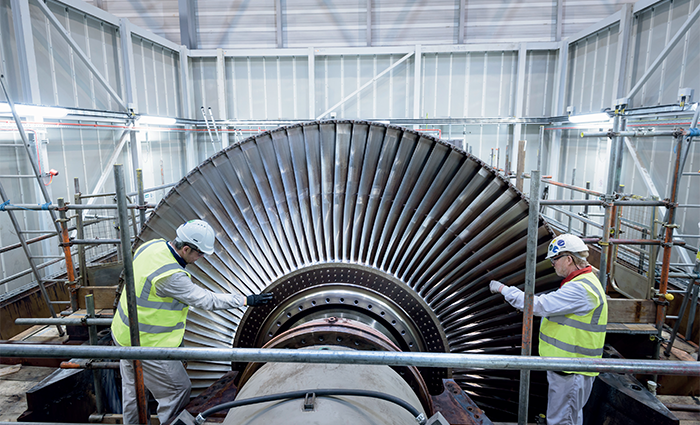

Originally built and commissioned by EDF in 2013, West Burton B is a highly flexible and efficient, 1300 megawatt (MW), combined-cycle gas turbine power station located in Nottinghamshire. The plant has been operated by West Burton Energy (WBE) since its acquisition from EDF by EIG, a US-based institutional investor, in August 2021. The facility, and its adjacent 50MW, half-hour Battery Energy Storage System (BESS) commissioned in 2018, operates within the UK electricity wholesale market, selling the power it generates back to EDF to be sold on to end users. The station is one of the most modern gas plants in the UK, as well as one of the most efficient. In its production of electricity, it burns less gas and releases fewer CO2 emissions than many of its competitor plants.

Chris Elder, Chief Executive Officer, took his post in January 2021. As he expands further, regarding the site’s capabilities: “The West Burton B gas plant is extremely flexible. From starting it up to achieving its minimum load, it only takes around an hour, and we’re able to provide a wide range of load profiles to National Grid, the system operator as well as offering services, such as frequency response and voltage support, with ease.

Chris Elder, Chief Executive Officer, took his post in January 2021. As he expands further, regarding the site’s capabilities: “The West Burton B gas plant is extremely flexible. From starting it up to achieving its minimum load, it only takes around an hour, and we’re able to provide a wide range of load profiles to National Grid, the system operator as well as offering services, such as frequency response and voltage support, with ease.

Despite the scheduled closure of its sister site in March 2023, West Burton A – a coal-fired power station that is still owned by EDF – WBE has plans to expand its energy facilities at the existing site. It has already submitted a planning application to construct a 500MW, two-hour BESS with the ability to power over 300,000 homes during peak electricity demand periods. “We are very positive about this technology. As more wind and solar plants are commissioned and built, there will need to be a low carbon source of flexibility and storage alongside existing gas plants,” he continues. “We have secured a grid connection and hope to receive our consent to build the project next year. We have a really good base of local support from our surrounding communities, and people are keen on the idea of us developing an energy park. This battery is slightly different from its existing 50MW counterpart, which is in place largely to provide grid services and support. The 500MW project, once built, will displace more of the expensive gas generation during peak periods of demand. The batteries will charge up overnight, whilst the prices and demand are lower, and will then be discharged when these both rise in the evening.”

Powering up

The majority of the battery storage systems currently in operation in the UK are 50MW or less, due to the time and costs associated with obtaining the necessary planning permissions. However, with recent regulatory changes, companies are now able to build larger projects by securing local planning consents only. This has presented the chance for developers such as WBE to consent larger sites which will benefit from economies of scale in terms of the grid connection costs and associated land and infrastructure.

This increasing scale reflects the trend seen for other renewable technologies. For example, the first offshore wind farms commissioned in the UK were typically around 100MW capacity, whereas today the larger offshore sites can be over 3000MW.

The owner of WBE, EIG, is keen to pursue further low carbon opportunities in the UK power sector. Chris cites its involvement as being a positive influence on WBE: “EIG is an investor that is solely focused on the energy sector, bringing with it a wealth of industry knowledge and expertise. It has a successful track record of deploying capital across the world, such as its founding of Harbour Energy back in 2014 – the largest listed independent oil and gas company in the UK. We’ve had a really solid 15 months with EIG, since it acquired West Burton. It has created an excellent platform from which we can pursue future acquisitions and development opportunities.”

In Chris’ opinion, there are three key contributing factors to the high power prices that consumers are experiencing this winter. Firstly, gas prices for this winter which have fluctuated between five and ten times higher than the historic norms, hence the increase in the cost of producing power for gas generators. This isn’t helped by the second issue that he raises: the UK’s reliance on imports from France to bolster electricity needs throughout the winter months. The level of imports this year has been much lower as the ageing French nuclear fleet in France has produced much less electricity than it normally would. Finally, the volatility of commodity prices generally means parties such as WBE are selling less electricity in advance than in previous years due to the high credit and transaction costs which arise from this volatility. This means that there are fewer sellers than there are buyers of electricity on a forward basis pushing up future prices.

Carbon capture

“It’s difficult to predict what’s going to happen next, if only I had a crystal ball,” Chris muses. “Going forward, as a management team, we are absolutely committed to the net-zero path in the longer term and we recognize that we need to employ carbon abatement strategies to get there with our gas station. The two pathways that we already have in mind, for our existing gas plant, include burning green hydrogen, as opposed to methane. We’re confident that we can burn up to 20 percent hydrogen by volume in the existing gas plant, without significant upgrades. The other pathway is retrofitting post-combustion carbon capture, with which we think we should be able to capture up to 90 percent of our carbon emissions, before transporting them to storage sites in the North Sea.

“Our vision is to have around five gigawatts of generation in operation, construction and development by 2026, about triple our base today,” he concludes. “We want to be a successful and flexible generation and storage business. That’s where we see our core strengths with the team we inherited at the West Burton site and our hires since then. There is so much opportunity right now in the UK and Europe, and with our nimble and courageous team, we are confident that our vision is achievable.”

westburtonenergy.com